REGULAR

Downtown Development Authority

Tuesday, March 19, 2023 8:30 AM

107 S.

Avenue, Suite 200 West Palm Beach, FL 33401

https://downtownwpb.com/DDA

Dial: +1 301 715 8592

Webinar ID: 890 6570 2574

CALL TO ORDER

PUBLIC COMMENTS AND QUESTIONS

EXECUTIVE DIRECTOR’S REPORT

PRESENTATIONS

• Annual Report FY 22 – 23

• Radius Survey Data

• Marshall Report

CONSENT CALENDAR (Action Required)

• Minutes of Regular Board Meeting February 20, 2024

• Financial Statements of February 29, 2024

OLD BUSINESS

• Block by Block

• Circuit Extension

NEW BUSINESS (Action Required)

• Audit FY 22 – 23

• Budget Amendment

ANNOUNCEMENTS

ADJOURNMENT

Rick Reikenis

Raphael Clemente

Teneka James-Feaman/ Tiffany Faublas

Michael Jennings

James Filippi

Rick Reikenis

Catherine Ast

Teneka James-Feaman

Vivian Ryland

Vivian Ryland

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833-8873|Fax: 561.833.5870| www.downtownwpb.com

AGENDA

BOARD MEETING

Olive

MEMO

TO:

DDA Board

Rick Reikenis, Chairman

Samantha Bratter

Varisa Lall Dass

Tim Harris

Daryl Houston

Bob Sanders

FROM: Teneka James-Feaman

RE: Presentations

DATE: Tuesday, March 19, 2024

Annual Report – This past year brought significant growth and change to Downtown West Palm Beach, with buildings rising, the residential population increasing, and new businesses opening. The DDA has continued to expand our programs to ensure that we keep pace with growth and our impact is felt district wide. As you will see in this report, the DDA expanded our public realm maintenance programs, increased our investment in mobility programs, and made some great improvements to public spaces with projects like the Fern Street Chess Park.

Radius Survey Data - The West Palm Beach Downtown Development Authority has worked with Radius global Market Research for the last several years to develop and analyze survey data. These studies will provide an updated understanding of market area residents in terms of awareness, visitation, perception of the area, and barriers to visitation as well as, for visitors, behavior, spending, and satisfaction Market Survey

- Dual mode survey (telephone and online) among households within 20 miles of the downtown area

- Sample size of 300

Visitor Survey

- On-site interview among visitors to the downtown area

- Sample size of 160

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

2024 Marshall Marketing Report – As a partner with WPBF, Channel 25, the DDA submitted several questions to be included as a part of their area consumer report. Representatives from Marshall Marketing and WPBF will be presenting the results from the survey data.

Staff utilizes the data collected to guide decisions regarding marketing and programming.

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

REGULAR BOARD MEETING MINUTES

Downtown Development Authority

Tuesday, February 20, 2024

8:30 AM

107 S. Olive Ave., Suite 200 West Palm Beach, FL 33401

https://downtownwpb.com/DDA

Dial: +1 301 715 8592

Webinar ID: 895 0094 5693

ATTENDANCE

DDA Board members in attendance: Chairman Rick Reikenis, Tim Harris, Daryl Houston, Varisa Lall Dass, Robert Sanders DDA Staff in attendance: Raphael Clemente, Teneka James-Feaman, Vivian Ryland, Catherine Ast, Krystal Campi, Tiffany Faublas, Samantha Moore, Sherryl Muriente and Attorney Max Lohman. Guests in attendance: Ana Maria Aponte, William Roger Cummings, Jonathan Hopkins, Josh Merkin, Lt. Greg Rideau, Chris Roog, and Tony Theissen. Virtual Guests in attendance: Peter Cruise.

CALL TO ORDER

Chairman Reikenis called the meeting to order at 8:40 a.m. Chairman Reikenis called a moment of silence in memory of Vice Chairman Bill Jacobson

PUBLIC COMMENTS

None.

EXECUTIVE DIRECTOR’S REPORT

Clemente reported that his trip to Tallahassee at the end of last month was successful. He joined colleagues from other Downtown Districts from across Florida to speak to State Legislature about House Bill 7013 and about issues specific to urban places across Florida. Clemente reported House Bill 7013 is going in right direction.

PRESENTATIONS

Mobility Coalition/WPBgo

Jonathan Hopkins, Mobility Coalition Executive Director, presented an update to the Board on progress the Coalition has made. Hopkins shared the mission which is to reduce traffic impacts and improve mobility in and around downtown to enable economic growth, save people’s precious time, and make everyday life easier. He shared The Coalition’s priorities and current projects. He added that the Coalition is a public-private partnership; currently one third of funding is from the private sector. FDOT has agreed to provide $75,000 in funding for the about 3 years starting in July. Hopkins stated that making sure we have solutions to meet the scale of our needs is key. Presentation available upon request.

Public Relations Report

Tony Theissen and Josh Merkin, representatives from rbb communications, presented a summary of Public Relations efforts on behalf of The DDA for the 2023 calendar year. Merkin highlighted some of the programs and events throughout the year that received great media coverage. He shared stats comparing 2022 to 2023; which showed a tremendous improvement in audience reach in 2023. Theissen added what’s on the Horizon and plans rbb communications has for upcoming DDA projects. Presentation available upon request.

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Ph: 561.833.8873 Fax: 561.833.5870 * DowntownWPB.com

CONSENT CALENDAR

Minutes of Regular Board Meeting January 16, 2024

Financial Statement of January 31, 2024

Sanders made a motion to approve the consent calendar. Harris seconded the motion. The motion passed unanimously.

OLD BUSINESS

Community Safety and Policing Pilot Program

Clemente stated that at the September 2023 DDA Board Meeting, the board approved a reduction in funding for the Ambassador Program to reallocate funds for increased policing. Since that time, this increased presence of law enforcement has yielded significant positive outcomes, as demonstrated by the data provided by the police department, and as noted from downtown stakeholder feedback.

The policing program began on October 1st and was approved for six months. With three months of supportive data available, staff recommends that the board approve the continuation of funding for the increased presence of police officers in the downtown area until the end of the current fiscal year. Extending this program from April 1st thought September 30th would require an additional $350,000 in funding. Staff is working to identify long-term funding for this program and will come back to the board with information as it is available.

Lt. Rideau presented an overview of the success of the program since its inception. He shared stats comparing the first quarter of response calls for 2021, 2022, and 2023. He highlighted some of the stats such as robberies are down 20%, burglaries are down 8%, and aggravated assaults down 40% The officers are able to patrol the streets of downtown and respond to calls quickly with bicycles and golf carts the DDA provided. Lt. Rideau also shared some of the success stories of the unhoused population that they were able to assist. Presentation available upon request.

Sanders made a motion to approve funding request of $350,000 for the Community Safety and Policing Pilot Program Harris seconded the motion. The motion passed unanimously.

NEW BUSINESS

None

ANNOUNCEMENTS

None

ADJOURNMENT

Harris made a motion to adjourn the meeting. Sanders seconded the motion. The motion passed unanimously. Meeting adjourned at 9:51 am.

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Ph: 561.833.8873 Fax: 561.833.5870 * DowntownWPB.com

Board Financials

West Palm Beach Downtown Development Authority

For the Period Ending February 29, 2024

Prepared on March 8, 2024

No CPA provides any assurance on these financial statements.

Balance Sheet

As of February 29, 2024

No CPA provides any assurance on these financial statements. 2/8

Total As of Feb 29, 2024 As of Feb 28, 2023 (PY) ASSETS Current Assets Bank Accounts PNC Bank Operating 650,851 1,639,579 PNC Investment Management Acct 6,308,928 5,005,431 Valley National Bank - MMA 163,087 160,895 Total Bank Accounts 7,122,866 6,805,905 Other Current Assets Interest Income Receivable 2,663 4,312 Petty Cash 50 50 Total Other Current Assets 2,713 4,362 Total Current Assets 7,125,579 6,810,267 Other Assets Lease Security Deposit 23,000 23,000 Total Other Assets 23,000 23,000 TOTAL ASSETS $7,148,579 $6,833,267 LIABILITIES AND EQUITY Liabilities Current Liabilities Other Current Liabilities Due to Lincoln National 6,033 5,612 Flexible Spending Withholding 224 -557 Payroll Liabilities 9,734 0 Suppl Med Ins. Premium Payable 250 95 Vision Premium Payable 43 -40 Total Other Current Liabilities 16,283 5,110 Total Current Liabilities 16,283 5,110 Total Liabilities 16,283 5,110 Equity Fund Balance 3,372,193 3,601,875 Net Income 3,760,103 3,226,282 Total Equity 7,132,296 6,828,157 TOTAL LIABILITIES AND EQUITY $7,148,579 $6,833,267

Monthly Budget Comparison

No CPA provides any assurance on these financial statements. 3/8

Total Actual Budget Remaining % Remaining INCOME CRA Project Funding 20,833 20,833 100.00 % DDA/City Interlocal Agreement 12,500 20,833 8,333 40.00 % DDA/CRA Interlocal 546,559 546,559 100.00 % Fees and Services 89 17 -72 -434.00 % Grants and Contributions 2,917 2,917 100.00 % Interest Income 5,649 1,833 -3,815 -208.00 % Reimbursements Reimbursment\\s - Physical Env 32,220 -32,220 Total Reimbursements 32,220 -32,220 Tax Revenues 212,355 279,271 66,916 24.00 % TIF -267,288 -267,288 100.00 % Total Income 262,813 604,976 342,163 57.00 % GROSS PROFIT 262,813 604,976 342,163 57.00 % EXPENSES Business Development Business Partnerships 1,002 8,333 7,332 88.00 % Business Training and Support 6,257 11,667 5,410 46.00 % Facade Improvements 12,500 12,500 100.00 % Grand Open/New Business 1,667 1,667 100.00 % Leasing/Brokers Meeting 998 2,500 1,502 60.00 % Property and Buss Incentives 31,250 31,250 100.00 % Total Business Development 8,257 67,917 59,660 88.00 % General Office Equipment, Computers, Programs 3,189 3,333 145 4.00 % General Office Expense 2,095 3,363 1,268 38.00 % General Postage 167 333 167 50.00 % Total General Office 5,450 7,029 1,579 22.00 % Insurance Expense 4,267 4,267 100.00 % Marketing/PR Advertising and Promotion 19,073 37,500 18,427 49.00 % Collateral Materials 11,140 10,909 -232 -2.00 % Community & Cultural Promotion 1,105 22,083 20,978 95.00 % Marketing Programs 3,008 12,500 9,492 76.00 % PR/Marketing 1,071 18,750 17,679 94.00 % Retail Promotion 100 5,000 4,900 98.00 % Value Added Events 6,296 12,500 6,204 50.00 %

February 2024

No CPA provides any assurance on these financial statements. 4/8 Total Actual Budget Remaining % Remaining Total Marketing/PR 41,794 119,242 77,448 65.00 % Neighborhoold Services Homeless Outreach 8,333 8,333 100.00 % Residential Programming 13,007 30,227 17,220 57.00 % Security and Policing 173,789 87,083 -86,705 -100.00 % Transportation 33,580 81,250 47,670 59.00 % Total Neighborhoold Services 220,376 206,894 -13,482 -7.00 % Operations Board Meeting 52 464 411 89.00 % Dues 450 500 50 10.00 % Hospitality 894 723 -170 -24.00 % Telephone Expense 246 833 587 70.00 % Total Operations 1,642 2,520 878 35.00 % Payroll Expenses Taxes 5,583 -5,583 Total Payroll Expenses 5,583 -5,583 Personnel Expense 7,155 91,667 84,512 92.00 % Dental Insurance 321 -321 Health Insurance -317 317 LIfe and Disability and ADD 707 -707 Payroll Expenses 0 0 Retirement - Pension 7,371 -7,371 Salary 74,611 -74,611 Total Personnel Expense 89,848 91,667 1,818 2.00 % Professional Services Accounting 2,500 2,792 292 10.00 % Audit 2,500 2,500 100.00 % Legal 1,033 2,375 1,342 57.00 % Professional Service 16,874 4,417 -12,457 -282.00 % Studies and Surveys 37,500 26,632 -10,868 -41.00 % Total Professional Services 57,906 38,715 -19,191 -50.00 % Public Realm Maintenance Capital Projects/Alleys 6,250 6,250 100.00 % Clean Team 33,337 44,583 11,246 25.00 % Graffitti Maintenance 1,000 1,458 458 31.00 % Holiday Lights 19,583 19,583 100.00 % Landscape Maintenance 34,293 61,896 27,602 45.00 % Pressure Washing/Street Clean 72,578 63,333 -9,245 -15.00 % Signage & Pedestrial Wayfinding 7,083 7,083 100.00 %

No CPA provides any assurance on these financial statements. 5/8 Total Actual Budget Remaining % Remaining Total Public Realm Maintenance 141,209 204,187 62,978 31.00 % Rent Expense 18,876 17,375 -1,501 -9.00 % Utilities 298 -298 Total Rent Expense 19,175 17,375 -1,800 -10.00 % Reserves 65,846 65,846 100.00 % Tax Collection 1,667 1,667 100.00 % Travel and Training 143 1,500 1,357 90.00 % Total Expenses 591,383 828,826 237,442 29.00 % NET OPERATING INCOME -328,570 -223,850 104,720 -47.00 % OTHER INCOME CRA Carryforward 197,794 197,794 100.00 % DDA Carryforward 26,056 26,056 100.00 % Total Other Income 0 223,850 223,850 100.00 % NET OTHER INCOME 0 223,850 223,850 100.00 % NET INCOME $ -328,570 $0 $328,570 3,285,701,200.00 %

No CPA provides any assurance on these financial statements. 6/8

Actual

YTD

2023

February 2024 Total Actual Budget over Budget % of Budget INCOME CRA Project Funding 104,167 -104,167 DDA/City Interlocal Agreement 30,125 104,167 -74,042 29.00 % DDA/CRA Interlocal 6,558,713 2,732,797 3,825,916 240.00 % Dividend Income 0 0 Fees and Services 362 83 278 434.00 % Gain or (Loss) on Investments 0 0 Grants and Contributions 14,583 -14,583 Interest Income 37,762 9,167 28,596 412.00 % Reimbursements Reimbursements-Buss Development 179 179 Reimbursment\\s - Physical Env 32,220 32,220 Total Reimbursements 32,399 32,399 Tax Revenues 3,037,043 1,396,356 1,640,687 217.00 % TIF -3,207,458 -1,336,441 -1,871,017 240.00 % Total Income 6,488,946 3,024,879 3,464,067 215.00 % GROSS PROFIT 6,488,946 3,024,879 3,464,067 215.00 % EXPENSES Business Development Business Partnerships 64,240 41,667 22,574 154.00 % Business Training and Support 6,257 58,333 -52,077 11.00 % Facade Improvements 150 62,500 -62,350 0.00 % Grand Open/New Business 800 8,333 -7,533 10.00 % Leasing/Brokers Meeting 4,896 12,500 -7,604 39.00 % Property and Buss Incentives 156,250 -156,250 Total Business Development 76,344 339,583 -263,240 22.00 % General Office Equipment, Computers, Programs 22,934 16,667 6,268 138.00 % General Office Expense 7,657 16,813 -9,155 46.00 % Investment Expenses 186 186 Total General Office Expense 7,843 16,813 -8,969 47.00 % General Postage 327 1,667 -1,340 20.00 % Total General Office 31,104 35,146 -4,042 89.00 % Insurance Expense 51,209 21,337 29,872 240.00 % Marketing/PR Advertising and Promotion 147,647 187,500 -39,853 79.00 % Collateral Materials 51,860 54,543 -2,683 95.00 % Community & Cultural Promotion 35,705 110,417 -74,712 32.00 %

YTD

vs

Budget October

-

No CPA provides any assurance on these financial statements. 7/8 Total Actual Budget over Budget % of Budget Marketing Programs 36,200 62,500 -26,300 58.00 % PR/Marketing 73,444 93,750 -20,306 78.00 % Retail Promotion 4,940 25,000 -20,060 20.00 % Value Added Events 33,041 62,500 -29,459 53.00 % Total Marketing/PR 382,836 596,209 -213,373 64.00 % Neighborhoold Services Community Engagement 5,000 5,000 Homeless Outreach 41,667 -41,667 Residential Programming 62,235 151,137 -88,903 41.00 % Security and Policing 478,649 435,417 43,232 110.00 % Transportation 239,779 406,250 -166,471 59.00 % Total Neighborhoold Services 785,662 1,034,470 -248,808 76.00 % Operations Board Meeting 152 2,318 -2,165 7.00 % Dues 4,091 2,500 1,591 164.00 % Hospitality 3,700 3,617 83 102.00 % Telephone Expense 3,287 4,167 -880 79.00 % Total Operations 11,229 12,601 -1,372 89.00 % Payroll Expenses Taxes 11,144 11,144 Total Payroll Expenses 11,144 11,144 Personnel Expense 28,888 458,333 -429,445 6.00 % Automobile Expense 1,500 1,500 Cable Stipend 0 0 Dental Insurance 1,607 1,607 Health Insurance 3,330 3,330 LIfe and Disability and ADD 3,535 3,535 Payroll Expenses 502 502 Payroll Taxes 14,003 14,003 Retirement - Pension 36,138 36,138 Salary 363,179 363,179 Unemployment 0 0 Total Personnel Expense 452,683 458,333 -5,651 99.00 % Professional Services Accounting 13,500 13,958 -458 97.00 % Audit 12,500 -12,500 Legal 3,129 11,875 -8,746 26.00 % Professional Service 23,470 22,083 1,386 106.00 % Studies and Surveys 37,725 133,159 -95,434 28.00 %

No CPA provides any assurance on these financial statements. 8/8 Total Actual Budget over Budget % of Budget Total Professional Services 77,823 193,576 -115,752 40.00 % Public Realm Maintenance Capital Projects/Alleys 2,450 31,250 -28,800 8.00 % Clean Team 153,404 222,917 -69,513 69.00 % Graffitti Maintenance 4,250 7,292 -3,042 58.00 % Holiday Lights 165,208 97,917 67,291 169.00 % Landscape Maintenance 129,248 309,478 -180,230 42.00 % Pressure Washing/Street Clean 250,254 316,667 -66,413 79.00 % Signage & Pedestrial Wayfinding 38,838 35,417 3,421 110.00 % Total Public Realm Maintenance 743,651 1,020,937 -277,285 73.00 % Purchases 5,500 5,500 Rent Expense 86,432 86,875 -443 99.00 % Utilities 298 298 Total Rent Expense 86,730 86,875 -145 100.00 % Reserves 329,228 -329,228 Tax Collection 8,023 8,333 -310 96.00 % Travel and Training 5,221 7,500 -2,279 70.00 % Total Expenses 2,729,160 4,144,128 -1,414,969 66.00 % NET OPERATING INCOME 3,759,787 -1,119,249 4,879,036 -336.00 % OTHER INCOME CRA Carryforward 988,972 -988,972 DDA Carryforward 130,278 -130,278 Other Miscellaneous Income 316 316 Total Other Income 316 1,119,249 -1,118,933 0.00 % NET OTHER INCOME 316 1,119,249 -1,118,933 0.00 % NET INCOME $3,760,103 $0 $3,760,102 7,520,205,040.00 %

MEMO

TO: DDA Board

Rick Reikenis, Chairman

Samantha Bratter

Tim Harris

Daryl Houston

Varisa Lall Dass

Bob Sanders

FROM: Catherine Ast, District Services Manager

RE: Block By Block Funding

DATE: March 19th, 2024

In January, the Board granted approval for staff to move forward with negotiations for an agreement with Block By Block (BBB). Staff has worked with BBB to identify the services that we believe will take us to the next level of service for the district.

We have determined funding and allocation for these services. Staff has invited Block by Block representatives back for informational purposes and to allow the Board the opportunity to ask any further questions.

Staff will be presenting the full agreement in April.

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

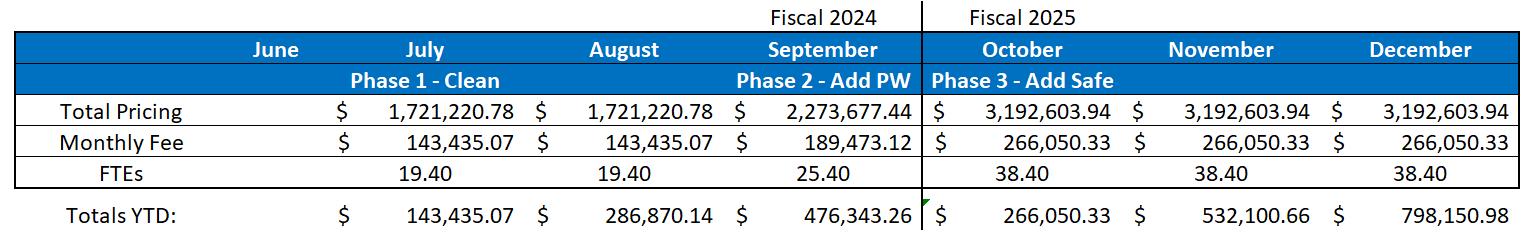

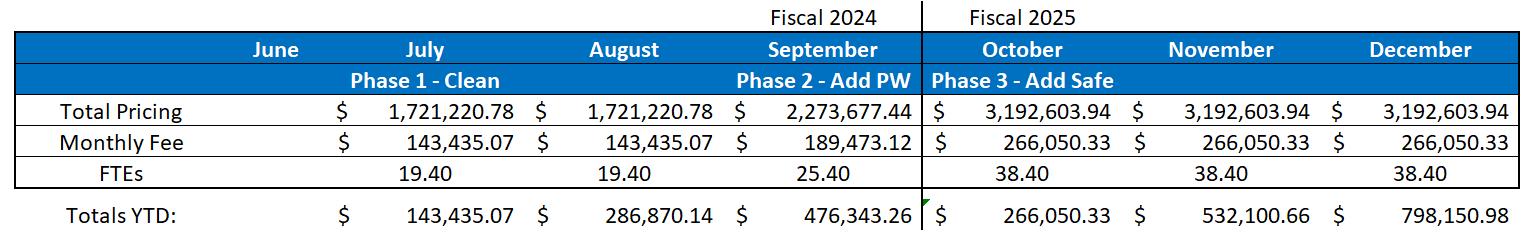

West Palm Beach Ambassador Program

Block By Block Pricing and Staff Counts by Phases

BLOCK BY BLOCK SCOPE OF WORK SYNOPSIS

PHASE 1

-

CLEANING AND TRASH AMBASSADORS:

This phase will take over the role of the Clean Team. Their main focus:

Remove litter and debris from throughout the District.

Empty right of way trash cans on Clematis sidewalks from Flagler to Tamarind.

Clean or remove graffiti throughout the District.

Assist staff with DDA produced Placemaking functions.

Wipe down trash cans.

PHASE 2 - ADD IN PRESSURE WASHING AMBASSADORS:

In phase 2 pressure washing will be incorporated into the BBB tasks. Their focus:

Clean streets and sidewalks of the Clematis Core more frequently.

Branch out into the District more often with more staff addressing less traveled areas throughout the daytime hours as well as overnight.

PHASE 3 - ADD SAFETY AMBASSADORS:

In Phase 3, we will finalize the buildout of the full services by adding Safety. Their focus:

These Ambassadors will continue to support and work with Police to improve safety efforts in the District.

They will incorporate a deeper role as a true Ambassador by adding hospitality training to be even more interactive with the public.

Patrolling, Condo and Business check ins.

Select Ambassadors will also work on homeless outreach to assist with this issue.

OVERALL: All of these programs will then be under one umbrella, working as a single team to better service the growing needs of the District. A single reporting system designed specifically for these duties will provide better data for staff to make adjustments and continue to improve the services for the Community.

MEMO

TO: DDA Board

Rick Reikenis, Chairman

Samantha Bratter

Tim Harris

Daryl Houston Varisa Lall Dass

Bob Sanders

FROM: Teneka James-Feaman

RE: Fourth Extension to Piggy-back Agreement with Circuit Transit, Inc.

DATE: Tuesday, March 19, 2024

The DDA entered into an agreement with Circuit Transit in August of 2021, via a “piggyback” on their contract with Pompano Beach and extended the agreement for an additional year in 2022. Since that time, Circuit has proven to be an effective and efficient way for residents and visitors to get around the downtown area. Brightline Trains and the City’s RideWPB have continued to merge their program with the Downtown Development Authority to maximize the available fleet of vehicles in the downtown area.

The agreement with Circuit Transit expires on April 15, 2024. Based on the success of the program and its growing popularity with stakeholders, it is recommended that the DDA enter into a fourth extension of the piggy-back agreement to commence April 15, 2024, through April 15, 2025

107 S Olive Avenue, Suite 200, West Palm Beach, FL 33401 Phone: 561.833.8873 - DowntownWPB.com

FOURTH EXTENSION TO AGREEMENT

West Palm Beach Downtown Development Authority Contractor: Circuit Transit, Inc.

Piggy-back Agreement:

City of Pompano Beach RFP # P-29-20, as extended by Ordinance 2024-20, dated February 13, 2024

This Fourth Extension of that certain Piggy-back Agreement (the “Agreement”), dated August 4, 2021 by and between Circuit Transit, Inc. a Florida Corporation with offices located at 501 East Las Olas Blvd, Fort Lauderdale, FL 33301 (hereinafter “Contractor”) and the West Palm Beach Downtown Development Authority, an Independent Special District, with offices located at 107 South Olive Avenue, Suite 200, West Palm Beach, Florida 33401 (hereinafter “DDA”) is hereby entered into this .

WITNESSETH:

DDA and Contractor, in consideration of the mutual covenants contained herein and other good and valuable consideration, the receipt and value of which is hereby acknowledged by both parties, hereby agree to extend the term of the Agreement, as follows:

Section 1. Paragraph 1. of the Agreement is hereby repealed and replaced in its entirety such that it shall hereafter read as follows:

1. DDA and Contractor both hereby agree to enter into this Agreement for Micro-Transit Transportation Services by piggy-backing unit rates and service pricing rates as set forth in the agreement between the City of Pompano Beach and the Contractor dated February 23, 2021 (the “Piggy-back Agreement”). This Agreement is effective on the date first written above with transportation services to run for a term commencing on October 18, 2021 and terminating on April 15, 2025, subject to the same terms and conditions set forth in the Piggy-back Agreement and as modified in this Agreement.

Section 2. Paragraph 6. of the Agreement is hereby repealed and replaced in its entirety such that it shall hereafter read as follows:

6. Contractor shall provide Micro-Transit Transportation Services as outlined in Exhibit “B” and DDA shall pay Contractor the Contract Price of $437,500 in accordance with the Contractor’s RFP Response, in conformance with the Piggy-back Agreement, for the specific services requested by the DDA. The Contract Price to be paid to Contractor shall be divided into equal payments of up to $35,000 per month beginning on April 15, 2024 through April 15, 2025, subject to any additional credits for advertising and ridership fare revenue that may be applied for the benefit of DDA. The month of April 2024 will be prorated from the 16th through the 30th in the amount of up to $17,500.00.

Page 1 of 2

Section 3. All the terms and conditions set forth in the Agreement shall remain in full force and effect except as specifically amended by the First Extension. No modification shall be made to this Third Extension unless such modification is in writing and signed by both parties.

WITNESSES: Contractor: James Mirras, President

WITNESSES:

Approved as to form and legal sufficiency

DDA: Raphael Clemente, Executive Director

R. Max Lohman, General Counsel

Page 2 of 2

MEMO

To: Rick Reikenis, Chairman

Samantha Bratter

Tim Harris

Daryl Houston

Varisa Lall Dass

Bob Sanders

From: Vivian Ryland

RE: Fiscal Year 2023 Financial Audit

Date: Tuesday, March 19, 2024

The DDA’s 2023 financial audit has been completed. There were no findings related to the DDA’s financial system design or the effectiveness of the system of internal control.

The audit determines the fund balance for the end of fiscal year 2023. The fund balance is $3,342,715. Of that, there is $688,882 that will be added to the fiscal year 2024 budget in a separate memo.

Staff recommends accepting the fiscal year 2023 financial audit report.

107 S. Olive Avenue, Suite 200, West Palm Beach, FL 33401 Ph: 561.833.8873 Fax: 561.833.5870 * DowntownWPB.com

WEST PALM BEACH

DOWNTOWN DEVELOPMENT AUTHORITY

FINANCIAL STATEMENTS WITH INDEPENDENT AUDITOR’S REPORT THEREON

FISCAL YEAR ENDED SEPTEMBER 30, 2023

PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY Table of Contents September 30, 2023 Page Number INDEPENDENT AUDITOR'S REPORT 1 MANAGEMENT'S DISCUSSION AND ANALYSIS 4 BASIC FINANCIAL STATEMENTS Government-wide Financial Statements Statement of Net Position 9 Statement of Activities .........................................................................................................................................10 Fund Financial Statements Balance Sheet – General Fund..............................................................................................................................11 Reconciliation of the Balance Sheet – General Fund to the Statement of Net Position........................................................................................................................12 Statement of Revenue, Expenditures and Changes in Fund Balance – General Fund...........................................................................................................................13 Reconciliation of the Statement of Revenue, Expenditures and Changes in Fund Balance of the General Fund to the Statement of Activities................................................................14 Notes to Financial Statements 15 REQUIRED SUPPLEMENTARY INFORMATION Budgetary Comparison Schedule – General Fund 29 Notes to Budgetary Comparison Schedule 31 Other Postemployment Benefits Schedule of Changes in the Total Other Postemployment Benefits (OPEB) Liability and Related Ratios 32 OTHER INFORMATION Information Required by Section 218.39(3)(c), Florida Statutes.............................................................................33 COMPLIANCE REPORTS AND MANAGEMENT LETTER Independent Auditor’s Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards.........................................................................34 Management Letter in Accordance with the Rules of the Auditor General of the State of Florida................................................................................................................36 Independent Accountant’s Report on Compliance with Section 218.415, Florida Statutes.........................................................................................................................38

WEST

INDEPENDENT AUDITOR’S REPORT

To the Board of Directors

West Palm Beach Downtown Development Authority

West Palm Beach, Florida

Report on the Audit of the Financial Statements

Opinions

We have audited the accompanying financial statements of the governmental activities and the major fund of the West Palm Beach Downtown Development Authority, as of and for the year ended September 30, 2023, and the related notes to the financial statements, which collectively comprise the West Palm Beach Downtown Development Authority’s basic financial statements as listed in the table of contents.

In our opinion, the financial statements referred to above present fairly, in all material respects, the respective financial position of the governmental activities and the major fund of the West Palm Beach Downtown Development Authority, as of September 30, 2023, and the respective changes in financial position for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinions

We conducted our audit in accordance with auditing standards generally accepted in the United States of America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the West Palm Beach Downtown Development Authority and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinions.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America; and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the West Palm Beach Downtown Development Authority’s ability to continue as a going concern for twelve months beyond the financial statement date, including any currently known information that may raise substantial doubt shortly thereafter.

1

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinions. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards and Government Auditing Standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with generally accepted auditing standards and Government Auditing Standards, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the West Palm Beach Downtown Development Authority’s internal control. Accordingly, no such opinion is expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the West Palm Beach Downtown Development Authority’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the management’s discussion and analysis on pages 4 through 8, the budgetary comparison information on pages 29 through 31, and the other postemployment benefit information on page 32 be presented to supplement the basic financial statements. Such information is the responsibility of management and, although not a part of the basic financial statements, is required by the Governmental Accounting Standards Board, who considers it to be an essential part of financial reporting for placing the basic financial statements in an appropriate operational, economic, or historical context. We have applied certain limited procedures to the required supplementary information in accordance with auditing standards generally accepted in the United States of America, which consisted of inquiries of management about the methods of preparing the information and comparing the information for consistency with management’s responses to our inquiries, the basic financial statements, and other knowledge we obtained during our audit of the basic financial statements. We do not express an opinion or provide any assurance on the information because the limited procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

Other Information

Management is responsible for the other information included in the annual report. The other information comprises the other information section but does not include the basic financial statements and our auditor’s report thereon. Our opinions on the basic financial statements do not cover the other information, and we do not express an opinion or any form of assurance thereon.

In connection with our audit of the basic financial statements, our responsibility is to read the other information and consider whether a material inconsistency exists between the other information and the basic financial statements, or the other information otherwise appears to be materially misstated. If, based on the work performed, we conclude that an uncorrected material misstatement of the other information exists, we are required to describe it in our report.

2

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated March 1, 2024, on our consideration of the West Palm Beach Downtown Development Authority’s internal control over financial reporting and on our tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of that report is solely to describe the scope of our testing of internal control over financial reporting and compliance and the results of that testing, and not to provide an opinion on the effectiveness of the West Palm Beach Downtown Development Authority’s internal control over financial reporting or on compliance. That report is an integral part of an audit performed in accordance with Government Auditing Standards in considering West Palm Beach Downtown Development Authority’s internal control over financial reporting and compliance.

West Palm Beach, Florida March 1, 2024

3

MANAGEMENT’S DISCUSSION AND ANALYSIS

Acting in our capacity as the management of the West Palm Beach Downtown Development Authority (“DDA”), we offer readers of the DDA’s financial statements this narrative overview and analysis of the financial activities of the DDA for the fiscal year ended September 30, 2023

The information contained within this Management’s Discussion and Analysis (MD&A) is only one component of the entire financial statement report. Readers should take time to read and evaluate all sections of the report, including the footnotes and the other Required Supplementary Information that is provided in addition to this MD&A

Financial Highlights

· The assets plus deferred outflows of resources of the DDA exceeded its liabilities plus deferred inflows of resources at the close of the most recent fiscal year by $3,501,590 (net position). Of this amount, $1,001,998 (unrestricted net position) may be used to meet the DDA’s ongoing obligations

· As of the close of the current fiscal year, the General Fund reported ending fund balance of $3,342,715, a decrease of $259,160 for the year. Approximately 69% of this fund balance is restricted and is to be used for specific projects pursuant to grant agreements and an Interlocal Agreement with West Palm Beach and its Community Redevelopment Agency (the “CRA”). Of the remaining amount, 1% is nonspendable, 9% is assigned for subsequent year’s expenditures, and 21% is unassigned and available for spending

Overview of the Financial Statements

This discussion and analysis is intended to serve as an introduction to the DDA’s basic financial statements The basic financial statements of the DDA comprise three components: (1) government-wide financial statements, (2) fund financial statements, and (3) notes to the financial statements. This report also contains required supplementary information in addition to the basic financial statements

Government-wide financial statements: The government-wide financial statements are designed to provide readers with a broad overview of the DDA’s finances, in a manner similar to a private-sector business.

The statement of net position (page 9) presents information on all of the DDA’s assets plus deferred outflows of resources and liabilities plus deferred inflows of resources, with the difference between the two reported as net position. Over time, increases or decreases in net position may serve as a useful indicator of whether the financial position of the DDA is improving or deteriorating

The statement of activities (page 10) presents information showing how the DDA’s net position changed during the most recent fiscal year. All changes in net position are reported as soon as the underlying event giving rise to the changeoccurs, regardless of the timing of related cash flow Thus,revenuesandexpensesarereportedinthisstatement for some items that will only result in cash flows in future fiscal periods (e.g., earned but unused vacation time).

The government-wide financial statements present functions of the DDA that are primarily supported by ad valorem property taxrevenues andoperating grants and contributionsrevenue Thegovernmental activities of the DDA include general government and various downtown improvement projects. The DDA has no business-type activities that are intended to recover all or a significant portion of their costs through user fees and charges

Fund financial statements: A fund is a grouping of related accounts that is used to maintain control over resources that have been segregated for specific activities or objectives. The DDA, like other state and local governments, uses fund accounting to ensure and demonstrate compliance with finance-related legal requirements The DDA has one fund category: governmental funds

Governmental funds: Governmental funds are used to account for essentially the same functions reported as governmental activities in the government-wide financial statements. However, unlike the government-wide financial statements, governmental fund financial statements focus on near-term inflows and outflows of spendable resources,

4

as well as on balances of spendable resources available at the end of the fiscal year. Such information may be useful in evaluating a government’s near-term financing requirements

Because the focus of governmental funds is narrower than that of the government-wide financial statements, it is useful to compare the information presented for governmental funds with similar information presented for governmental activities in the government-wide financial statements By doing so, readers may better understand the long-term impact of the DDA’s near-term financing decisions. Both the governmental fund balance sheet and the governmental fund statement of revenues, expenditures and changes in fund balance provide a reconciliation to the corresponding government-wide financial statement to facilitate this comparison between the two The DDA’s only governmental fund is the General Fund

The basic General Fund financial statements can be found on pages 11 and 13 of this report The reconciliations between the General Fund financial statements and the government-wide financial statements can be found on pages 12 and 14

Notes to the financial statements: The notes begin on page 15 and provide additional information that is essential to a full understanding of the data provided in the government-wide and fund financial statements.

Other information: In addition to the basic financial statements and accompanying notes, this report also presents certain other required supplementary information This includes the budget to actual results for the General Fund for the current year and a schedule of other postemployment benefits information which is presented immediately after the basic financial statements on pages 29 through 32

Government-Wide Financial Analysis

Net position: The table below is a summary of the Statement of Net Position at September 30, 2023 and 2022

West Palm Beach Downtown Development Authority

Statement of Net Position – Governmental Activities September 30, 2023 and 2022

5

2023 2022 ASSETS Current and other assets $ 3,718,324 $ 3,754,351 Capital assets, net 1,014,375 1,163,681 Total assets 4,732,699 4,918,032 DEFERRED OUTFLOWS OF RESOURCES 17,701 17,708 LIABILITIES Noncurrent liabilities outstanding 846,734 926,208 Other liabilities 375,609 152,476 Total liabilities 1,222,343 1,078,684 DEFERRED INFLOWS OF RESOURCES 26,467 26,445 NET POSITION Investment in capital assets 206,586 302,608 Restricted 2,293,006 2,795,540 Unrestricted 1,001,998 732,463 Total net position $ 3,501,590 $ 3,830,611

As noted earlier, net position may serve over time as a useful indicator of a government’s financial position In the case of the DDA, assets plus deferred outflows of resources exceeded liabilities plus deferred inflows of resources by 3,501,590 at the close of the most recent fiscal year As of September 30, 2023, approximately 29% of the DDA’s net position is unrestricted and may be used to meet the DDA’s ongoing obligations to the business community and creditors An additional 65% of net position is restricted for projects and programs outlined in the City/CRA/DDA interlocal agreement and grant agreements. The remaining 6% reflects the DDA’s investment in capital assets

Change in Net Position: The table below is a comparative summary of the changes in net position for the fiscal years ended September 30, 2023 and 2022:

West Palm Beach Downtown Development Authority

of Activities – Governmental Activities

The DDA’s net position decreased $329,021 in 2023 Total revenues increased approximately $1,911,000 in 2023 This was primarily the result of an increase in operating grants and contributions of approximately $1,260,000 due to an increase in operating revenue from the CRA and an increase in tax revenues of approximately $506,000 due to increased property valuations and related interest earned. Total expenses increased by approximately $1,501,000 or 19% This is primarily the result of an increase in administrative expenses by approximately $555,000 which is primarily due to the increase inthe CRA tax increment, anincrease in marketing and public relations by approximately $197,000 due to a new digital campaign, an increase in business development by approximately $111,000 due to an increase in the demand for downtown commercial space and build out, an increase in public realm maintenance by approximately $353,000 due to the increase in traffic and visitors, and an increase in neighborhood services of approximately $285,000 due to an increase in events.

6

For the Fiscal Years

September

2023 and 2022 2023 2022 REVENUES Program revenues: Charges for services $ 5,437 $ 7,550 Operating grants and contributions 6,042,046 4,782,039 General revenues Property taxes 2,993,756 2,487,566 Investment income 155,797 8,821 Total revenues 9,197,036 7,285,976 EXPENSES Economic environment Administrative 4,368,197 3,812,903 Marketing and public relations 952,766 756,129 Business development 319,484 209,018 Public realm maintenance 1,840,143 1,486,921 Neighborhood services 2,011,951 1,727,087 Interest on long-term liabilities 33,516 32,395 Total expenses 9,526,057 8,024,453 Change in net position (329,021) (738,477) Net position, beginning of year 3,830,611 4,569,088 Net position, end of year $ 3,501,590

3,830,611

Statement

Ended

30,

$

Financial Analysis of the General Fund

General Fund: The purpose of the DDA’s General Fund financial statements is to provide information on near-term inflows, outflows, and balances of spendable resources Such information is useful in assessing the DDA’s financing requirements In particular, unassigned fund balance may serve as a useful measure of a government’s net resources available for spending at the end of the fiscal year. As of September 30, 2023, the DDA’s General Fund reported endingfund balanceof $3,342,715, adecrease of$259,160 for 2023. Approximately21% ofthis amount is unassigned fund balance, which is available for spending at the DDA’s discretion The remainder consists of 1% that is nonspendable for prepaid items, 69% that is restricted for CRA and other projects, and 9% that is assigned for the 2023/2024 budget As a measure of the General Fund’s liquidity, it may be useful to compare both unassigned fund balance and total fund balance to total fund expenditures. Unassigned fund balance represents approximately 8% of total General Fund expenditures, while total fund balance represents approximately 35% of that same amount

General Fund Budgetary Highlights

The annual General Fund budget is adopted after two public hearings and approval by the DDA’s Board. Any amendments that would exceed the original budget at the fund level or would require funds to be transferred from reserves would require a formal budget amendment by the Board. A budget increase in the amount of $1,074,934 was approved during 2023, which is mainly a result of obtaining final figures from the CRA regarding the DDA’s current year workplan

Revenues for 2023 were over budget by approximately $67,000, excluding the General Fund carryforward fund balance. This was primarily the result of positive variances in property taxes and investment earnings. Expenditures were under budget by approximately $3,276,000, of which the following are considered noteworthy: (1) Professional services expenditures were under budget by approximately $41,000 due projects waiting for City/CRA approval, (2) marketing and public relations expenditures were under budget by approximately $109,000 due to less printed material, (3) business development was under budget by approximately $550,000 due to delays in permitting of build outs, (4) public realm maintenance expenditures were under budget by approximately $720,000 due going to a flat rate of pressure washing in the five sections in downtown, (5) neighborhood services expenditures, including the trolley, were under budget by approximately $408,000 due to the cancellation of the trolley

Capital Assets

The DDA’s investment in capital assets as of September 30, 2023, amounts to $1,014,375 (net of accumulated depreciation and amortization) This investment in capital assets includes lease asset – buildings, leasehold improvements, equipment, and furniture and fixtures. The net decrease in the DDA’s investment in capital assets for the current fiscal year was $149,306, which was comprised of depreciation and amortization expense of $149,306 The details of capital assets can be found in Note C to the financial statements.

Debt Administration

The DDA has no debt outstanding as of September 30, 2023 except for a lease liability incurred due to the implementation of GASB 87 – Leases The lease liability had a balance of $807,789 as of September 30, 2023 The details of long-term liabilities can be found in Note D to the financial statements and the details for leases can be found in Note I to the financial statements

Next Year’s Budget

For fiscal year 2024, the DDA adopted a final General Fund budget of $9,945,908 representing an increase of approximately 12% from the fiscal year 2023 final budget.

Economic Factors and Rates

The DDA has a stable property tax base Property taxes represent approximately 33% of the 2023 budgeted revenues of the DDA (excluding carryforward fund balance), and CRA funding represents approximately 65% of budgeted revenues The balance of the projected revenues comes from various miscellaneous sources

7

Requests for Information

This financial report is designed to provide a general overview of the DDA’s finances for all those with an interest in the DDA’s finances Questions concerning any of the information provided in this report or requests for additional financial information should be addressed to the DDA’s Executive Director at 300 Clematis Street, Suite 200, West Palm Beach, FL 33401

8

BASIC FINANCIAL STATEMENTS

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

STATEMENT OF NET POSITION September 30, 2023 Governmental Activities ASSETS Cash and cash equivalents 3,656,736 $ Interest receivable 13,427 Prepaid expenses 25,161 Deposits 23,000 Capital assets Right to use lease asset, net of accumulated amortization 748,504 Capital assets being depeciated, net of accumulated depreciation 265,871 Total assets 4,732,699 DEFERRED OUTFLOWS OF RESOURCES Deferred amounts related to other postemployment benefits 17,701 LIABILITIES Accounts payable and accrued expenses 375,609 Noncurrent liabilities Due within one year 75,987 Due in more than one year 770,747 Total liabilities 1,222,343 DEFERRED INFOWS OF RESOURCES Deferred amounts related to other post employment benefits 26,467 NET POSITION NetiInvestment in capital assets 206,586 Restricted for: Community Redevelopment Agency work plan 2,258,006 Dining on the spot program 25,000 Placemaking program 10,000 Unrestricted 1,001,998 Total net position 3,501,590 $ See notes to the financial statements 9

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

STATEMENT OF ACTIVITIES

For the Fiscal Year Ended September 30, 2023

Net (Expense) Revenue and Changes in Program Revenues Net Position Charges Operating Total for Grants and Governmental Functions / Programs Expenses Services Contributions Activities Governmental activities Economic environment Administrative 4,368,197 $ - $ 1,225,603 $ (3,142,594) $ Marketing and public relations 952,766 - 857,094 (95,672) Business development 319,484 5,437 419,841 105,794 Public realm maintenance 1,840,143 - 1,747,607 (92,536) Neighborhood services 2,011,951 - 1,791,901 (220,050) Interest on long-term liabilities 33,516 - - (33,516) Total governmental activities 9,526,057 $ 5,437 $ 6,042,046 $ (3,478,574) General revenues Property taxes 2,993,756 Investment earnings - unrestricted 155,797 Total general revenues 3,149,553 Change in net position (329,021) Net position, beginning of year 3,830,611 Net position, end of year 3,501,590 $ See notes to the financial statements 10

WEST

FUND September 30, 2023 ASSETS Cash and cash equivalents 3,656,736 $ Interest receivable 13,427 Prepaid items 25,161 Deposits 23,000 Total assets 3,718,324 $ LIABILITIES AND FUND BALANCE LIABILITIES Accounts payable and accrued expenses 375,609 $ FUND BALANCE Nonspendable: Prepaid items and security deposits 48,161 Restricted for: Community Redevelopment Agency work plan 2,258,006 Dining on the spot program 25,000 Placemaking program 10,000 Assigned to: Subsequent year's expenditures 312,666 Unassigned 688,882 Total fund balance 3,342,715 Total liabilities and fund balance 3,718,324 $ See notes to the financial statements 11

PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY BALANCE SHEET - GENERAL

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

RECONCILIATION OF THE BALANCE SHEET - GENERAL FUND TO THE STATEMENT OF NET POSITION

Amounts reported for governmental activities in the statement of net position are different because: Capital

used in governmental activities are not financial resources and therefore are not reported in the governmental funds.

not due and payable in the current period and therefore are not reported in the governmental funds.

Deferred

of resources and deferred inflows of resources related to defined benefit pension plans and other postemployment benefits are applicable to future periods and are not reported in the governmental funds.

September

Fund balance - General Fund 3,342,715 $

30, 2023

Governmental capital assets 1,523,341 Less accumulated depreciation and amortization (508,966) Long-term liabilities

Compensated absences (14,924) Total other postemployment benefits liability (24,021) Lease liability (807,789)

assets

are

Deferred outflows related to other postemployment benefits 17,701 Deferred inflows related to other postemployment benefits (26,467) Net position of governmental activities 3,501,590 $ See notes to the financial statements 12

outflows

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

STATEMENT OF REVENUE, EXPENDITURES, AND CHANGES IN FUND BALANCE - GENERAL FUND

For the Fiscal Year Ended September 30, 2023

REVENUE Property taxes 2,993,756 $ Intergovernmental 5,765,076 Investment earnings 155,797 Charges for services 5,437 Reimbursements 3,937 Grants 273,033 Total revenues 9,197,036 EXPENDITURES Current Economic environment Administrative 4,245,052 Marketing and public relations 952,766 Business development 319,484 Public realm maintenance 1,840,143 Neighborhood services 2,011,951 Capital outlay Debt service: Principal 53,284 Interest 33,516 Total expenditures 9,456,196 Change in fund balance (259,160) Fund balances, beginning of year 3,601,875 Fund balances, end of year 3,342,715 $ See notes to the financial statements 13

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

RECONCILIATION OF THE STATEMENT OF REVENUES, EXDPENDITURES, AND CHANGES IN FUND BALANCE OF THE GENERAL FUND TO THE STATEMENT OF ACTIVITIES

For the Fiscal Year Ended September 30, 2023

Amounts reported for governmental activities in the statement of activities are different because:

Governmental funds report capital outlays as expenditures However, in the statement of activities, the cost of capital assets is allocated over their estimated useful lives and reported as depreciation and amortization expense.

The issuance of long-term debt provides current financial resources to governmental funds, while the repayment of the principal of long-term debt consumes the current financial resources of governmental funds Neither transaction has any effect on net position.

Some

reported in the statement of activities do not require the use of current financial resources and therefore are not reported as expenditures in the General Fund.

Net change in fund balance - General Fund (259,160) $

Less: current year depreciation and amortization (149,306)

Principal payments on long-term lease liabilities 53,284

expenses

Change in compensated absences payable 27,292 Change in total other postemployment benefits liability and related deferred amounts (1,131) Change in net position of governmental activities (329,021) $ See notes to the financial statements 14

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

September 30, 2023

NOTE A – SIGNIFICANT ACCOUNTING POLICIES

Financial Reporting Entity: The West Palm Beach Downtown Development Authority (the “DDA”) was established byaspecialactoftheFloridaLegislatureinHouseBill1029,regularsession1967,effectiveJune8,1967.Thepurpose of the DDA is to develop and revitalize the downtown area of the City of West Palm Beach, Florida (the “City”). The DDA’s services are rendered wholly within the boundaries of the DDA, and its activities and transactions are intended to benefit the DDA by returning improved property to the City’s tax rolls, enhancing the business and cultural environment of the downtown area and providing employment to its citizens.

The DDA has the power to levy taxes on property owners within the designated downtown development area The DDA’s property tax levy and the levies of the City are independent of each other and are related only by the fact that they are levied against a common tax base within the DDA’s geographic boundaries

TheBoardofDirectorsoftheDDAisappointedbytheCity’smayor,butthereisnosignificant continuingrelationship between the City and the DDA for carrying out day-to-day functions of the DDA The management of the DDA is selected by its Board of Directors and the operation of the DDA is the exclusive responsibility of such management. Moreover, the City is under no obligation to fund operating deficits of the DDA, has not guaranteed and has no moral responsibility for any debt of the DDA, does not provide financial resources, or otherwise exercise significant influence over the DDA’s operations

As required by generally accepted accounting principles, these financial statements include the DDA (the primary government) and its component units. Component units are legally separate entities for which the DDA is financially accountable The DDA is financially accountable if:

a) the DDA appoints a voting majority of the organization’s governing board and (1) the DDA is able to impose its will on the organization or (2) there is a potential for the organization to provide specific financial benefits to or impose specific financial burdens on the DDA, or

b) the organization is fiscally dependent on the DDA and (1) there is a potential for the organization to provide specific financial benefits to the DDA or (2) impose specific financial burdens on the DDA

Organizations for which the DDA is not financially accountable are also included when doing so is necessary in order to prevent the DDA’s financial statements from being misleading

Based upon application of the above criteria, management of the DDA has determined that no component units exist which would require inclusion in this report. Further, the DDA is not aware of any entity that would consider the DDA to be a component unit

Government-wide Financial Statements: The government-wide financial statements consist of the Statement of Net Position and the Statement of Activities and report information on all governmental activities of the DDA. The DDA has no business-type activities. The Statement of Net Position presents the financial condition of the DDA, including all long-term assets and long-term liabilities

The Statement of Activities demonstrates the degree to which the direct expenses of a given function or identifiable activity is offset by program revenue Direct expenses are those that are clearly identifiable with a specific function or identifiable activity. Program revenue generally includes three categories of transactions: (1) charges to customers or applicants who purchase, use, or directly benefit from goods, services or privileges provided by a given function or segment; (2) operating grants and contributions; and (3) capital grants and contributions. Ad valorem property tax

15

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

September 30, 2023

NOTE A – SIGNIFICANT ACCOUNTING POLICIES (Continued)

Government-wide Financial Statements (Continued)

revenue and other items not meeting the definition of program revenue are reported as general revenues The DDA does not allocate indirect expenses.

Fund Financial Statements: The underlying accounting system of the DDA is organized and operated on the basis of separate funds, each of which is considered to be a separate accounting entity The operations of each fund are accounted for with a separate set of self-balancing accounts that comprise its assets, liabilities, fund equity, revenue and expenditures or expenses, as appropriate

Governmental resources are allocated to and accounted for in individual funds based upon the purposes for which they are to be spent and the means by which spending activities are controlled. The fund used by the DDA is classified into one category: governmental

Governmental Fund Financial Statements – Governmental Fund Financial Statements include a Balance Sheet and a Statement of Revenue, Expenditures and Changes in Fund Balance for the General Fund, the DDA’s only governmental fund An accompanying schedule is presented to reconcile and explain the differences in fund balance and changes in fund balance as presented in these statements, to the net position and changes in net position presented in the government-wide financial statements The DDA’s major governmental fund is as follows:

General Fund – This fund is used to account for all operations of the DDA. Revenue is derived primarily from property taxes and intergovernmental revenue received from the West Palm Beach Community Redevelopment Agency (the “CRA”).

Measurement Focus and Basis of Accounting: The government-wide financial statements are reported using the economic resources measurement focus and the accrual basis of accounting, as are the fiduciary fund financial statements Revenuesarerecognizedwhenearnedandexpensesarerecognizedwhenincurred,regardlessofthetiming of related cashflows Propertytaxes are recognized as revenue in the yearforwhich they arelevied Grants andsimilar items are recognized as revenues as soon as all eligibility requirements imposed by the provider have been met.

Governmental fund financial statements are reported using the current financial resources measurement focus and the modified accrual basis of accounting Under the modified accrual basis of accounting, revenues are recognized in the period in which they become both measurable and available. Revenues are considered to be available when collectible within the current period or soon enough thereafter to pay liabilities of the current period The DDA considers revenues to be available if collected within 60 days after the end of the fiscal year. Expenditures are generally recognized in the accounting period in which the fund liability is incurred Ad valorem property tax revenue, intergovernmental revenue, and investment income are all considered susceptible to accrual and have been recognized as revenues in the current fiscal year. All other revenue items are considered to be measurable and available only when received in cash by the DDA.

When both restricted and unrestricted resources are available for use, it is the DDA’s policy to use restricted resources first, then unrestricted resources as they are needed

Cash and Cash Equivalents: The DDA considers highly liquid investments maturing in three months or less when purchased to be cash equivalents, unless intended to be held as investments.

16

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

September 30, 2023

NOTE A – SIGNIFICANT ACCOUNTING POLICIES (Continued)

Investments: Investments are stated at fair value Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value is a market-based measurement, not an entity-specific measurement For some assets and liabilities, observable market transactions or market information might be available; for others, it might not be available. However, the objective of fair value measurement in both cases is the same, that is, to determine the price at which an orderly transaction to sell the asset or to transfer the liability would take place between market participants at the measurement date under current market conditions Fair value is an exit price at the measurement date from the perspective of a market participant that controls the asset or is obligated for the liability. The DDA categorizes investments reported at fair value in accordance with the fair value hierarchy established by GASB Statement No 72, Fair Value Measurement and Application.

Prepaid Items: Certain payments to vendors reflect costs applicable to future accounting periods and are recorded as prepaid items in both government-wide and fund financial statements In the governmental funds, prepaid items are recorded using the consumption method and are offset by the nonspendable fund balance component which indicates they do not constitute available spendable resources, even though they are a component of current assets

Capital Assets: The DDA has reported all capital assets in the government-wide Statement of Net Position Capital assets are defined by the DDA as assets with an initial, individual cost of more than $1,500 and an estimated useful life in excess of one year. Capital assets are recorded at cost or, if donated, acquisition value at the date of donation Expenditures that materially extend the useful life of existing assets are capitalized Certain costs for professional services associated with the acquisition and construction of capital assets have been capitalized The cost of capital assets sold or retired is removed from the appropriate accounts and any resulting gain or loss is included in the change in net position Depreciation is computed on capital assets using the straight-line method over the assets’ estimated useful lives The estimated useful life of equipment, furniture and fixtures is three to ten years Leasehold improvements are being amortized over the ten-year life of the corresponding lease

Leases: Lease contracts that provide the DDA with control of a non-financial asset, such as land, buildings, or equipment, for a period of time in excess of twelve months are reported as an intangible right to use lease asset with a related lease liability. The lease liability is recorded at the present value of future lease payments, including fixed payments,variablepaymentsbasedonanindexorfixedrateandreasonablycertainresidualguarantees Theintangible right to use leased asset is recorded for the same amount as the related lease liability plus any prepayments and initial direct costs to place the asset in service Leased assets are amortized over the shorter of the useful life of the asset or the lease term. The lease liability is reduced for lease payments made, less the interest portion of the lease payment.

Lease contracts that provide an external entity with control of the DDA’s non-financial asset, such as land, buildings, or equipment, for a period of time in excess of twelve months are reported as a leased receivable with a related lease deferred inflow of resources. The lease receivable is recorded at the present value of future lease payments expected to be received during the lease term, reduced by any provision for estimated uncollectible amounts The lease deferred inflow of resources is recorded for the same amount as the related lease receivable less any lease incentives. Leased deferred inflow of resources are amortized over the lease term. The lease receivable is reduced for lease payments made, less the interest portion of the lease payment.

Compensated Absences: The DDA allows employees to accrue sick leave and carry over unused time to future years. Unused sick leave is not paid out upon termination and, accordingly, no liability is accrued for sick leave Vacation time is earned on a calendar year basis, but must be used by January 31st of the following year or it is lost Accrued vacation at September 30, 2023, represents the amount of vacation that has been earned, but not used, as of that date

17

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

September 30, 2023

NOTE A – SIGNIFICANT ACCOUNTING POLICIES (Continued)

Deferred Outflows/Inflows of Resources: In addition to assets and liabilities, the government-wide Statement of Net Position reports a separate section for deferred outflows or deferred inflows of resources. The separate financial statement element, deferred outflows of resources, represents a consumption of net assets that applies to a future period(s) and so will not be recognized as an outflow of resources (expense/expenditure) until that time. The deferred outflows of resources related to OPEB results from changes in assumptions and other inputs and are deferred and amortizedtoOPEBexpense inasystematicandrationalmanneroveraperiodequaltotheaverageexpectedremaining service lives of employees that are provided with benefits through the plan

The separate financial statement element, deferred inflows of resources, represents an acquisition of net assets that applies to a future period(s) and so will not be recognized as an inflow of resources (revenues) until that time. The DDA’s deferred inflows reported on the government-wide Statement of Net Position relate to its other postemployment benefits (OPEB) liability. The deferred inflows of resources related toOPEB results from differences between expected and actual experience and changes in assumptions and are deferred and amortized to OPEB expense in a systematic and rational manner over a period equal to the average expected remaining service lives of employees that are provided with benefits through the plan

Property Taxes: Ad valorem property tax revenues are calculated at 95% of the taxable value of property within the DDA’s taxing boundaries as certified by the Palm Beach County Property Appraiser. The DDA may levy ad valorem taxes on such property at a maximum rate of two mills ($2 00 per $1,000 of taxable value) for operating purposes

Actual collections may differ from property taxes levied due to discounts, tax assessment appeals and corrections made subsequent to July 1

All property is assessed at its fair market value on January 1st of each year by the Palm Beach County Property Appraiser. Taxes are levied on November 1st of each year and unpaid taxes become delinquent on April 1st following the yearin which theyarelevied Discounts areallowed for early payment atthe rateof4% in themonthofNovember, 3% in the month of December, 2% in the month of January, and 1% in the month of February. Taxes paid in March are without discount. Taxes paid after April 1 are assessed penalties and interest

Budget: The DDA’s Board of Directors adopts the ensuing year’s operating budget prior to September 30th each year Thebudgetincludesproposedexpendituresandthemeansoffinancingthem.Budgetsareadoptedonabasisconsistent with the modified accrual basis of accounting

Risk Management: The DDA is exposed to various risks of loss related to torts; theft of, damage to, and destruction ofassets;errorsandomissions;injuriestoemployees;andnaturaldisasters.TheDDApurchasescommercialinsurance for the risks of losses to which it is exposed Policy limits and deductibles are reviewed annually by management and established at amounts to provide reasonable protection from significant financial loss. Settlements have not exceeded insurance coverage for any of the prior three fiscal years

Net Position/Fund Balances: The government-wide financial statements utilize a net position presentation Net position is categorized as follows:

Net Investment in Capital Assets – This component of net position consists of capital assets reduced by accumulated depreciation and by any outstanding liabilities incurred to acquire, construct, or improve those assets, excluding unexpended proceeds

18

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

September 30, 2023

NOTE A – SIGNIFICANT ACCOUNTING POLICIES (Continued)

Net Position/Fund Balances (Continued)

Restricted – This component of net position consists of constraints placed on the use of net position by external restrictions imposed by creditors (such as through debt covenants), grantors, contributors, or laws or regulations of other governments or constraints imposed by law through constitutional provisions or enabling legislation

Unrestricted – This component of net position consists of net position that does not meet the definition of Investment in Capital Assets or Restricted

The governmental fund financial statements report fund equity classifications that comprise a hierarchy based primarily on the extent to which the DDA is legally bound to honor the specific purposes for which amounts in fund balance may be spent The fund balance classifications are summarized as follows:

Nonspendable – Nonspendable fund balance includes amounts that cannot be spent because they are either (a) not in spendable form, or (b) legally or contractually required to remain intact

Restricted – Restricted fund balance includes amounts that are restricted to specific purposes either by (a) constraints placed on the use of resources by creditors, grantors, contributors, or laws or regulations of other governments, or (b) imposed by law through constitutional provisions or through enabling legislation

Committed – Committed fundbalance includes amounts thatcan onlybe used for specific purposes pursuant to constraints imposed by the Board of Directors through an ordinance or resolution

Assigned – Assigned fund balance includes amounts that are constrained by the DDA’s intent to be used for specific purposes, but are neither restricted nor committed. Assignments of fund balance are made by DDA management based upon direction by the Board of Directors or through the annual budget

Unassigned – Unassigned fund balance includes amounts that have not been restricted, committed, or assigned to specific purposes

The fund balance policy also establishes a spending order when a qualifying expenditure is incurred for which those funds are available, of restricted fund balances first, followed by committed, then assigned, and finally unassigned fund balances.

Minimum Fund Balance Policy: The DDA has not adopted a formal minimum fund balance policy Generally, the DDA strives to maintain a sufficient General Fund fund balance to provide liquidity in the event of a budget shortfall or natural disaster.

Implementation of GASB Statements: The following GASB Statements were effective for the DDA for the fiscal year ended September 30, 2023:

GASB Statement No. 91, Conduit Debt Obligation. This Statement will provide a single method of reporting conduit debt obligations by issuers and eliminate diversity in practice associated with commitments extended by issuers, arrangements associated with conduit debt obligations, and related note disclosures Implementation of this Statement did not have an impact on the DDA’s financial statements.

19

WEST PALM BEACH DOWNTOWN DEVELOPMENT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

September 30, 2023

NOTE A – SIGNIFICANT ACCOUNTING POLICIES (Continued)

Implementation of GASB Statements (Continued)

GASB Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements. This Statement will improve financial reporting by establishing the definitions of public-private and publicpublic partnership arrangements (PPPs) and availability payment arrangements (APAs) and providing uniform guidance on accounting and financial reporting for transactions that meet those definitions. Implementation of this Statement did not have an impact on the DDA’s financial statements

GASB Statement No. 96, Subscription-Based Information Technology Arrangements. This Statement provides guidance on the accounting and financial reporting for subscription-based information technology arrangements (SBITAs) for government end users (governments). Implementation of this Statement was immaterial to the DDA’s financial statements.